VATRE Links

Questions or Comments?

Email Us @

tatumelections@tatumisd.org

What is a VATRE?

Did you Know?

When is the Election?

Safety and Security Measures

Increase Teacher and Staff Salaries, Retention Incentives & Benefits

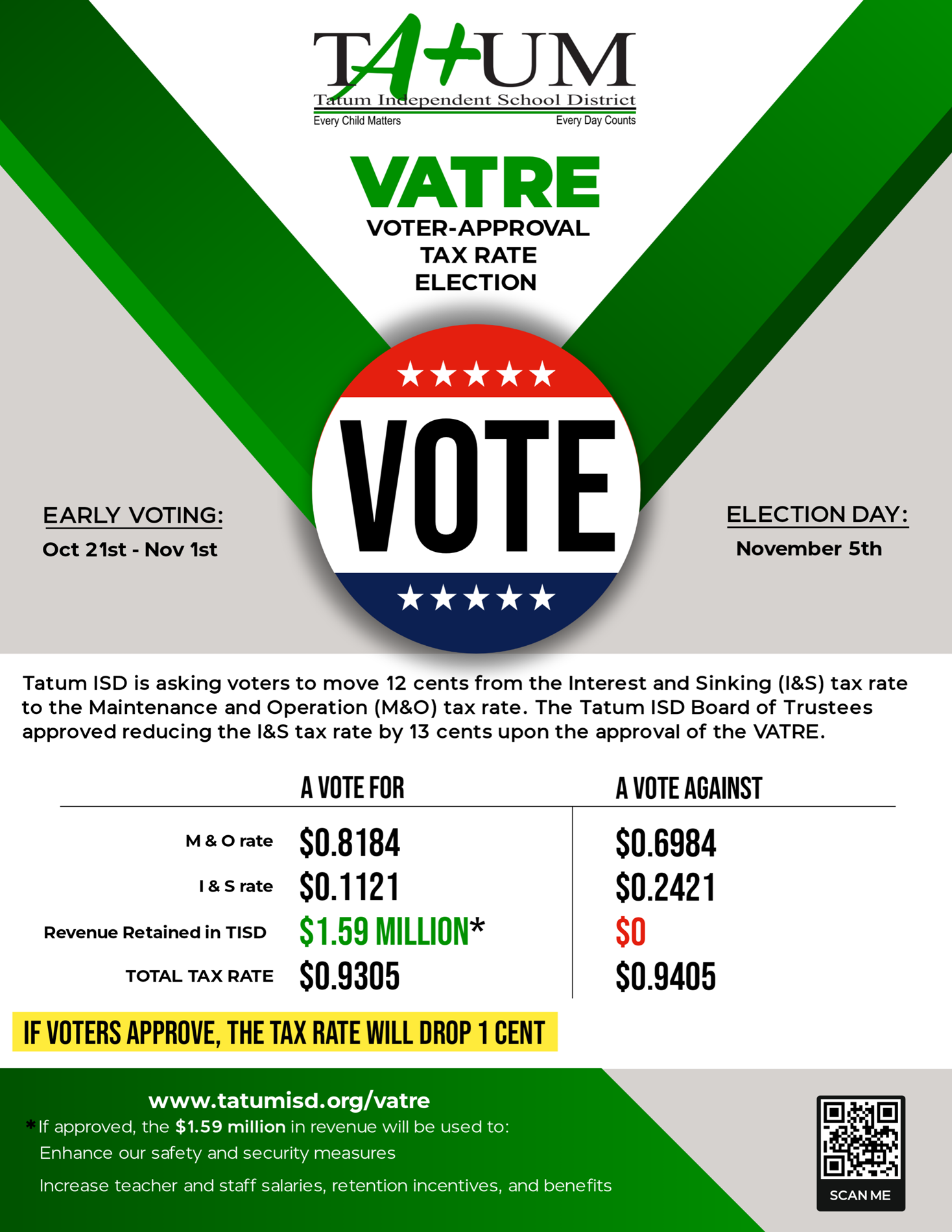

Why call a VATRE?

The VATRE if approved by the voters, would drop the overall tax rate for the taxpayers.

The VATRE would generate over $1.5 million annually for Tatum ISD. These funds will:

Enhance our safety and security measures, and

Increase teacher and staff salaries, retention incentives, and benefits

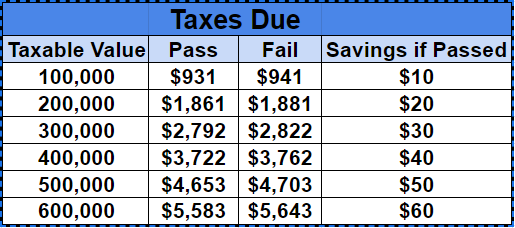

Tax Impact

Impact on Property Owner: If approved, would represent an average $10 yearly decrease on a home that is valued at $100,000. If not approved, then there would be an average increase of $10 yearly.

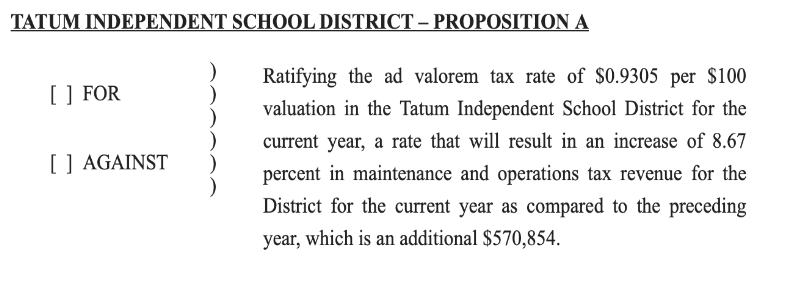

What does the ballot language mean?

What voters will see on the ballot is only information about the increase to the M&O side of the tax rate. The ballot language is set by state law and may lead voters to think the district is raising taxes, when in fact the overall tax rate is decreasing.

The November ballot will ask voters to ratify the total tax rate, including the I&S (debt service tax rate), not just the M&O rate. The 8.67% percent is equal to the $570,854 in M&O taxes. The other way to describe the ballot language is the following:

- The tax rate of $0.9305 is the total tax rate that includes both the M&O tax rate and the I&S tax rate. The ballot language is required to have the total tax rate.

- The increase of 8.67 percent. This is not an increase due to the 12 cents; this is an increase in total tax collections across the district.

- The additional $570,854. This is not an increase due to the 12 cents; this is an increase due to an increase in property values across the district.

F.A.Q.

The Tatum ISD tax rate consists of two components: the maintenance and operations tax rate and the interest and sinking tax rate. The maintenance and operations tax rate covers all district expenses except bond debt, while the interest and sinking tax rate is solely for bond debt payments.

School districts are funded primarily by local property taxes and state aid. However, rising property values do not equate to more money for schools. Instead, when property values increase, the State of Texas reduces the amount of money it sends the district on the Tier I portion of the tax rate. There is no adjustment in the state funding formulas for inflation.

Utilizing employee attrition to strategically reduce payroll including administration and support staff

Reducing district-level expenditures

Utilize the district’s fund balance to offset the deficits

Use grant money to supplement when it can

As with school districts across the nation, Tatum ISD received three series of one-time payments from the federal government in the form of ESSER funding. These funds existed in a finite timeframe and are no longer provided; all funds are legally required to be used by September 2024. Districts received varying monetary amounts of ESSER funding based on their socioeconomic demographics.

Of the ESSER funding Tatum ISD received, over $3.2 million was allocated specifically for payroll and retention stipends during the 2022-23 and 2023-24 school years to support recruitment and retention within the district.

Property Insurance 164% (For Example in 2019 our budget was $97,000 …… in 2024-2025 our budget is $255,800)

Gasoline & Fuels 80% (For Example in 2019 our budget was $50,000 in 2024-2025 our budget is $90,000)

Safety and Security 53.8% (TISD received only $350k from the state to complete mandated safety and security requirements and has spent over $1 million to keep our students and staff safe)

Electricity 13.6% (For Example in 2019 our budget was $550,000 in 2024-2025 our budget is $625,000)

Tatum ISD has been paying off debt with the extra 13 cents for many years now. Tatum ISD has the opportunity to pass a VATRE which would be a tax savings to the taxpayers.

Over the past few years, Tatum ISD has been making cash defeasance payments, enabling the district to pay off bond debt ahead of schedule. By paying down our debt early, we're saving taxpayers money on interest. The district's financial strategy, which includes maintaining a stable I&S tax rate while reducing debt, is designed to optimize the use of taxpayer funds and ensure long-term financial sustainability.

Rising prices, the need to fairly compensate staff and lower attendance and enrollment rates post-pandemic, all play a role in the school funding challenges across the state. Since 2019, there has been no increase to the basic allotment — currently $6,160 per student — which is the amount the state allots for each student in a district.

The approval of the VATRE would provide the necessary funding to maintain smaller class sizes, retain and attract high-quality teachers, and support essential student programs and student experiences. The additional revenue would ensure that the district can continue offering a robust educational experience, including extracurricular activities, advanced academic programs, and support services that contribute to student success.

Tatum ISD has a preliminary rating of an A in the Texas Education Agency's Financial Integrity Rating System of Texas, or FIRST. Tatum ISD received a Superior rating by scoring 100 points out of 100 possible points. Link to Rating

Additionally, independent auditors had no findings for Tatum ISD in fiscal year 2023. No material weaknesses were identified and no significant deficiencies with internal controls or financial reporting were identified.

If the VATRE ballot proposal does not pass, Tatum ISD will not have access to additional funding. This will limit the district’s ability to offer competitive salaries and benefits to attract and retain employees In addition, staffing levels may have to be reduced, and safety and security upgrades will be limited.

Tatum ISD would have to consider increasing the number of students per class, eliminating some academic and extracurricular student programs, and eliminating positions that both directly and indirectly support students.